Transcontinental Inc. increases its revenues and profitability in the first quarter and declares a special dividend of $1.00 per participating share

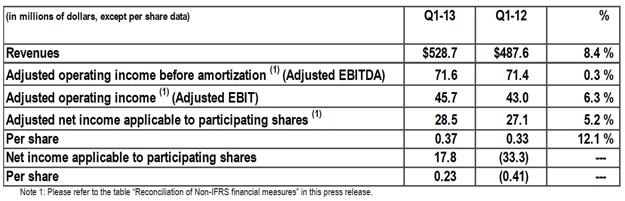

Montreal, March 13, 2013 – Revenues for Transcontinental Inc. (TSX: TCL.A, TCL.B, TCL.PR.D) were up 8.4% in the first quarter, from $487.6 million to $528.7 million, mainly due to the acquisition of Quad/Graphics Canada, Inc. and Redux Media and the Métro Montréal daily paper in the Media Sector. This increase was, however, partly offset by the termination of the Zellers flyer printing and distribution contract due to the closure of the Zellers stores, and the incentives granted upon the renewal of some contracts in 2012.

Highlights

- Declared special dividend of $1.00 per participating share or approximately $78 million.

- Received US$200 million pursuant to the renegotiation of the Hearst Corporation agreement.

- Extended several multi-year agreements, namely with Best Buy and Future Shop, to print flyers with the addition of flyer distribution primarily in Quebec and the Atlantic provinces.

- Concluded new multi-year printing agreements for new business valued at about $30 million annually.

- Appointment of Ted Markle as President of TC Media.

- Acquired Groupe Modulo, publisher of French-language educational materials.

Adjusted operating income rose 6.3% in the first quarter, from $43.0 million to $45.7 million. The increase stems mainly from the synergies obtained from the acquisition of Quad/Graphics Canada, Inc. and the optimization of the operating structure in digital activities. However, the increase was mitigated by the reasons mentioned above. Net income applicable to participating shares rose, from a loss of $33.3 million, or $0.41 per share, to a profit of $17.8 million, or $0.23 per share. Note that last year the loss of $0.41 per share was mainly related to unusual items charged to income in the first quarter of 2012. Excluding unusual items, the adjusted net income applicable to participating shares rose 5.2%, from $27.1 million, or $0.33 per share, to $28.5 million, or $0.37 per share.

"The growth in our revenues and profitability demonstrates how effectively we executed our strategy," said François Olivier, President and Chief Executive Officer of TC Transcontinental. "In the Printing Sector, with the ongoing integration of Quad/Graphics Canada, Inc., we have generated further synergies this quarter. We are confident that we will be able to keep improving our profitability over last year given the additional synergies we expect to generate through the ongoing integration of Quad/Graphics Canada, Inc., and with the additional business from new multi-year agreements valued at about $30 million per year which will begin in the next two quarters. We continue to gain our customers' confidence with the quality and diversity of our solutions and expertise."

Other Highlights

Printing Sector

- Concluded new multi-year printing agreements with several retailers, namely Shoppers Drug Mart, to print point-of-sale promotional materials, and with Safeway U.S. to print flyers. These agreements will add about $30 million in annual sales.

- Extended several multi-year agreements, including a contract to print flyers for the well-known brands Best Buy and Future Shop, with the addition of flyer distribution in Quebec and the Atlantic provinces. These extensions demonstrate our customers' confidence in our expertise and the quality of products and services.

- Continued consolidation and restructuring of the printing network as part of the ongoing integration of Quad/Graphics Canada, Inc. This allows us to focus on the use of our most productive equipment and leverage the more than $700 million invested over the past several years to upgrade the printing platform.

Media Sector

- Launched four flagship brands on iPad. The iPad issues of Coup de pouce, Canadian Living, ELLE Québec and Elle Canada enhance TC Transcontinental's multi-platform offering with inspiring and relevant content as well as interactive features exclusive to the platform.

- Acquired Groupe Modulo, publisher of French-language educational materials. This transaction enriches TC Media's offering in the education field by further strengthening its leading position in higher education in Quebec. It also increases its presence in the educational market in Francophone communities in the rest of Canada.

Financial Highlights

- Received US$200 million pursuant to the renegotiation of the Hearst Corporation agreement.

- In the first quarter ended January 31, 2013, under its share purchase program, the Corporation redeemed 1,161,600 Class A Subordinate Voting Shares at a weighted average price of $9.98, for a total consideration of $11.6 million. As of today, the Corporation has completed 96% of its share purchase program. TC Transcontinental plans to renew its normal course issuer bid when the current program expires, subject to regulatory approval.

- Extension for one year of the $400 million credit facility. The facility matures in February 2018. At January 31, 2013, an amount of $148 million had been drawn on this facility.

Sustainable Development

- Publication of the fourth annual sustainability report, titled "simplify, collaborate, innovate". With the level of information provided in the report, TC Transcontinental has maintained its application level B rating under the Global Reporting Initiative. For more information about TC Transcontinental's commitments, achievements and progress in sustainability, please refer to the 2012 report on the Corporation's website at www.tc.tc/sustainability.

For more detailed financial information, please see Management's Discussion and Analysis for the first quarter ended January 31st, 2013 as well as the financial statements in the "Investors" section of our website at www.tc.tc

Outlook

The contribution from the synergies obtained from the integration of Quad/Graphics Canada, Inc. will continue, particularly in the second and third quarters of 2013, partially offset however by the closure of the Zellers stores. New agreements to print flyers and marketing products worth an annualized value of around $30 million are slated to start at the end of the second quarter of 2013.

The Media Sector will continue to be affected by difficult market conditions, particularly with respect to advertising spending by our national and local clients. To limit the potential impact of these conditions, efficiency measures are being implemented to protect and improve the sector's profit margins. We will also pursue our efforts to improve the profitability of our digital and interactive offering by further reducing our cost base while continuing to invest in the development of new products.

Significant excess cash flows will continue to be generated in coming quarters, and we plan to invest about $70 million in property, plant and equipment, as well as intangible assets, in fiscal 2013. Our excellent financial position will also allow us to distribute a special dividend in the second quarter of 2013 of $1.00 per participating share, totaling approximately $78 million, while sustaining the financial flexibility that enables us to make strategic acquisitions and invest in in-house projects.

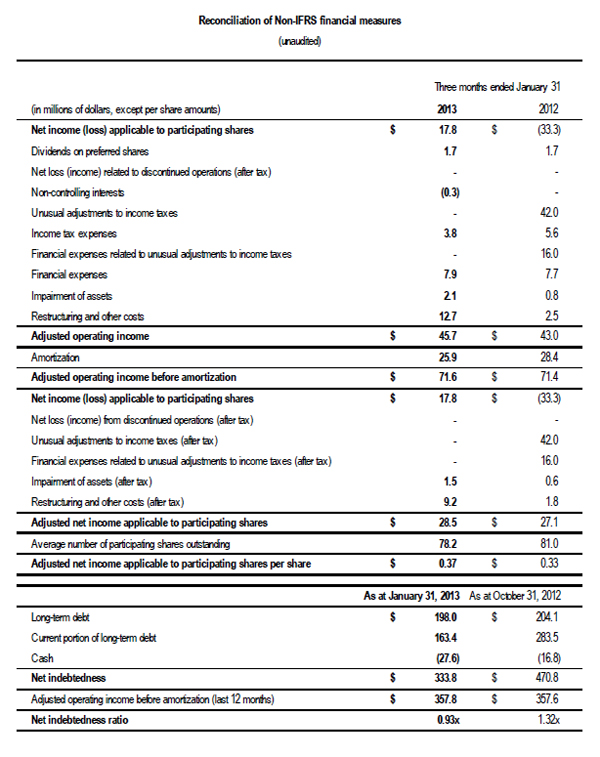

Reconciliation of Non-IFRS Financial Measures

Financial data have been prepared in conformity with IFRS. However, certain measures used in this press release do not have any standardized meaning under IFRS and could be calculated differently by other companies. We believe that many readers analyze our results based on certain non-IFRS financial measures because such measures are more appropriate for evaluating the Corporation's operating performance. Internally, Management uses such non-IFRS financial information as an indicator of business performance, and evaluates management's effectiveness with specific reference to these indicators. These measures should be considered in addition to, not as a substitute for or superior to, measures of financial performance prepared in accordance with IFRS.

The following table reconciles IFRS financial measures to non-IFRS financial measures.

Dividends

Dividend on Participating Shares

The Corporation's Board of Directors declared a quarterly dividend of $0.145 per Class A Subordinate Voting Shares and Class B Shares. This dividend is payable on April 26, 2013 to participating shareholders of record at the close of business on April 5, 2013.

Dividend on Preferred shares

The Board declared a quarterly dividend of $0.4161 per share on cumulative 5-year rate reset first preferred shares, series D. This dividend is payable on April 15, 2013. On an annual basis, this represents a dividend of $1.6875 per preferred share.

Special Dividend

The Corporation's Board of Directors declared a special dividend of $1.00 per Class A Subordinate Voting Shares and Class B Shares or approximately $78 million. This dividend is payable on April 26, 2013 to participating shareholders of record at the close of business on April 5, 2013.

Additional Information

Annual Meeting of Shareholders

Transcontinental Inc. will hold its Annual Meeting of Shareholders today at 10:00 AM at Salon Windsor of the Le Windsor building, 1170 Peel Street, Montreal. For those who are unable to attend in person, a live (audio only) webcast of the meeting will be available on the Corporation's website at www.tc.tc

Conference Call

Upon releasing its first quarter 2013 results, the Corporation will hold a conference call for the financial community today at 2:00 p.m. The dial-in numbers are (514) 807-9895 or (647) 427-7450 or 1-888-231-8191 and the access code is: 10295595. Media may hear the call in listen-only mode or tune in to the simultaneous audio broadcast on the Corporation's Web site, which will then be archived for 30 days. For media requests for information or interviews, please contact Nathalie St-Jean, Senior Advisor, Corporate Communications of TC Transcontinental, at (514) 954-3581.

Profile

Largest printer and leading provider of media and marketing activation solutions in Canada, TC Transcontinental creates products and services that allow businesses to attract, reach and retain their target customers. The Corporation specializes in print and digital media, the production of magazines, newspaper, books and custom content, mass and personalized marketing, interactive and mobile applications, TV production and door-to-door distribution.

Transcontinental Inc. (TSX: TCL.A, TCL.B, TCL.PR.D), known by the brands TC Transcontinental, TC Media and TC Transcontinental Printing, has approximately 9,500 employees in Canada and the United States, and reported revenues of C$2.1 billion in 2012. Website www.tc.tc

Forward-looking Statements

This press release contains certain forward-looking statements concerning the future performance of the Corporation. Such statements, based on the current expectations of management, inherently involve numerous risks and uncertainties, known and unknown. We caution that all forward-looking information is inherently uncertain and actual results may differ materially from the assumptions, estimates or expectations reflected or contained in the forward-looking information, and that actual future performance will be affected by a number of factors, many of which are beyond the Corporation's control, including, but not limited to, the economic situation, structural changes in its industries, exchange rate, availability of capital, energy costs, increased competition, as well as the Corporation's capacity to engage in strategic transactions and integrate acquisitions into its activities. The risks, uncertainties and other factors that could influence actual results are described in the Management's Discussion and Analysis (MD&A) for the fiscal year ended on October 31st, 2012 and in the 2012 Annual Information Form and have been updated in the MD&A for the first quarter ended January 31st, 2013.

The forward-looking information in this release is based on current expectations and information available as at March 12, 2013. The Corporation's management disclaims any intention or obligation to update or revise any forward-looking statements unless otherwise required by the Securities Authorities.

- 30 -

For information:

Media

Nathalie St-Jean

Senior Advisor, Corporate Communications

TC Transcontinental

Telephone : 514 954-3581

nathalie.st-jean@tc.tc

www.tc.tc

Financial Community

Jennifer F. McCaughey

Senior Director, Investor Relations and External Corporate Communications

TC Transcontinental

Telephone : 514 954‑2821

jennifer.mccaughey@tc.tc

www.tc.tc