Transcontinental Inc. Increases its revenues by 12% and adjusted operating income by 21% in the 4th quarter

Highlights of the Fourth Quarter

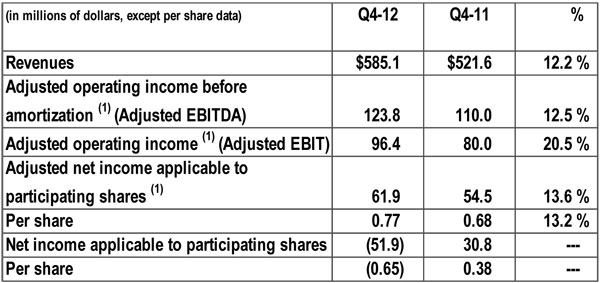

- Increase of 12.2% in revenues and 20.5% in adjusted operating income.

- Increase of 12.5% in adjusted operating income before amortization.

- Decrease in net income applicable to participating shares due to unusual items totaling $113.5 million.

- Reached an agreement in principle with Hearst Corporation for new terms and conditions to print the San Francisco Chronicle.

- Continued integration of Quad/Graphics Canada, Inc., which was acquired on March 1, 2012.

- Start of TC Media's television production activity.

- Maintained a solid financial position with a net indebtedness ratio of 1.32x.

Montreal, December 6, 2012 – Transcontinental Inc. (TSX: TCL.A TCL.B TCL.PR.D) ended fiscal 2012 on a very good note with revenues up 12.2% in the fourth quarter from $521.6 million to $585.1 million. This increase is mainly due to the acquisition of Quad/Graphics Canada, Inc. and acquisitions in the Media Sector, namely Redux Media. Excluding acquisitions and closures, and the impact of fluctuations in the exchange rate and paper, organic revenue growth was $0.8 million, or 0.2%.

Fourth quarter adjusted operating income rose 20.5%, from $80.0 million to $96.4 million. This increase stems mainly from the synergies from the integration of Quad/Graphics Canada, Inc., the optimization of the operational structure of digital operations and a higher volume from educational book publishing activities. Adjusted net income applicable to participating shares, which excludes unusual items and discontinued operations, rose 13.6%, from $54.5 million, or $0.68 per share, to $61.9 million, or $0.77 per share. Net income applicable to participating shares declined, from $30.8 million, or $0.38 per share, to a loss of $51.9 million, or $0.65 per share. This decrease stems mainly from a $57.2 million impairment charge of the carrying value of our U.S. deferred tax asset related to a decrease of activities in this country.

"I am especially pleased with how we have ended fiscal 2012, said François Olivier, President and Chief Executive Officer. As expected, despite the volatile advertising market, revenues and profitability in the fourth quarter grew due to the contribution from the integration of Quad/Graphics Canada, Inc. and the good performance of the Media Sector.

In 2012, thanks to the strategic acquisition of Quad/Graphics Canada, Inc., we confirmed our position as Canada's largest printer. In the midst of this transaction, we integrated a certain number of the acquired plants into our state-of-the-art printing network in order to maximize the utilization of our most efficient equipment. Furthermore, we sold operations which we considered less strategic for the Corporation over the longer term. We renewed several multi-year printing and distribution agreements and we launched and acquired titles to expand the scope of our newspaper network. In addition, because of our excellent financial position and our ability to generate significant cash flows, we maintained the necessary flexibility to continue to develop TC Transcontinental. We continued to enhance our new services by entering the television production space, by investing in our flagship brands, by expanding the scope of our digital advertising representation and by continuing to rollout mobile apps for our clients and our own brands. I am certain that our achievements in the past year put us in an excellent position to pursue our transformation."

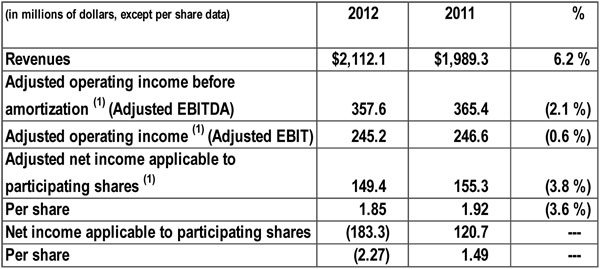

Highlights of Fiscal 2012

In 2012, TC Transcontinental's revenues increased 6.2%, from $1,989.3 million to $2,112.1 million. This increase stems mainly from the acquisitions of Quad/Graphics Canada, Inc. and Redux Media. It was, however, mitigated by the incentives granted at the renewal of certain printing contracts and by non-recurring revenue from the printing contract for the Canadian Census in 2011. Adjusted operating income remained relatively stable, from $246.6 million to $245.2 million. The slight decrease of 0.6% derives primarily from the Media Sector, due to the end of the school reform in Quebec, which impacted educational book publishing revenues, as well as a soft national advertising market. The decrease was mitigated by new printing contracts, the synergies from the integration of Quad/Graphics Canada, Inc., and the optimization of the operational structure of our digital operations.

Net income applicable to participating shares declined, from $120.7 million, or $1.49 per share, to a loss of $183.3 million, or $2.27 per share. The decrease stems mainly from a $232.0 million asset impairment related to the Media Sector, which was non-cash. The decrease also stems from a $58.0 million provision for notices of re-assessment from tax authorities, which the Corporation is currently contesting, a $57.2 million impairment charge of the carrying value of our U.S. deferred tax asset, and $55.0 million in restructuring and other costs mostly related to the integration of Quad/Graphics Canada, Inc. These items were, however, partially offset by a gain on acquisition of $32.1 million. Excluding unusual items and discontinued operations, adjusted net income applicable to participating shares decreased 3.8%, from $155.3 million, or $1.92 per share, to $149.4 million, or $1.85 per share.

For more detailed financial information, please see Management's Discussion and Analysis for the fiscal year ended October 31st, 2012 as well as the financial statements in the "Investors" section of our website at www.tc.tc

Subsequent event: Transcontinental Inc. and Hearst Corporation have reached an agreement in principle for new terms and conditions to print the San Francisco Chronicle

Transcontinental Inc. and Hearst Corporation today reached an agreement in principle to amend the terms and conditions of the 15-year contract started July 2009 to print the San Francisco Chronicle. Under the new agreement, which will be effective January 1st, 2013, TC Transcontinental will receive a one-time cash payment of US$200 million from Hearst Corporation to compensate for price reductions on future services. TC Transcontinental will continue to print the Chronicle over the term of the agreement, receive payment for services and maintain ownership of the printing plant and equipment.

Given the new market reality in the San Francisco Area, the Chronicle will only require the use of up to two-thirds of the printing equipment under the original contract. As a result, the Chronicle will benefit from price reductions of approximately US$30 million per year from TC Transcontinental, over the remaining term of the agreement, to account for the upfront payment and the reduction in the use of the printing equipment.

The impact on the profitability of TC Transcontinental's Fremont, California plant will not be significant as the US$200 million upfront payment will be deferred and transferred to revenues over the remaining life of the contract and the Corporation will be able to reduce its cost base to compensate for the reduction in the use of the required printing equipment. Furthermore, TC Transcontinental will focus on using the available capacity for other potential customers.

"We are pleased to continue to foster our growing relationship with Hearst Corporation, not only in printing, but also in magazine publishing, with our Elle brand partnership in Canada, and in digital solutions with our advertising representation partnership," said François Olivier, president and CEO of Transcontinental Inc.

Other Highlights of Fiscal 2012

Strengthening core operations

For the Printing Sector, the acquisition of Quad/Graphics Canada, Inc., which was completed on March 1, 2012, should generate close to $200 million in annual revenues and a net increase in adjusted operating income before amortization of more than $40 million by the end of 2014, of which $11.4 million was realized in 2012. In the midst of this transaction, the Corporation began reorganizing its printing operations in Canada by ensuring the use of its most productive equipment. Moreover, black and white book printing operations were sold in 2012. A number of multi-year agreements with retail customers and with Rogers, valued at more than $1.75 billion, were renewed and expanded.

In fiscal 2012, the Media Sector expanded its content offering by acquiring or launching several community newspapers and purchasing, from its partners, all outstanding shares of the Métro Montréal newspaper. The introduction of the brand Fresh Juice, which offers food-related content on a number of different platforms, and the addition of Éditions Caractère to the portfolio of educational books for the general public, enhanced the catalogue of titles published by the Corporation. However, in the process of reviewing its brand portfolio and to channel its efforts toward the development of its leading multiplatform brands, the Corporation decided to stop publishing the More and Vita brands.

Development of new services

In 2012, TC Transcontinental added television production to its service offering. Several mobile apps were also developed for its own properties and those of its partners, namely On the Table and P$ Mobile Service for Stationnement de Montréal. The job search site JobGo.ca was also launched. In addition, the Corporation expanded its digital offering by signing numerous advertising representation agreements and partnerships and by acquiring Redux Media, a leading online advertising network. Through its innovation program, the Corporation introduced Panoramax, the largest promotional insert in Canada printed on high-volume presses.

Financial highlights

The adjusted net indebtedness ratio improved from 1.48x as at October 31, 2011 to 1.32x as at October 31, 2012. Under its share purchase program, as at October 31, 2012, the Corporation bought back 2,011,600 of its Class A Subordinate Voting Shares at a weighted average price of $8.86, for a total consideration of $17.8 million. Transcontinental Inc. also put in place a new five-year unsecured term-credit facility of $400 million which matures in February 2017. An amount of $194.9 million was drawn on this facility as at October 31, 2012.

Changes in the Board of Directors

On February 16, 2012, Rémi Marcoux stepped down as Chair of the Board of Transcontinental Inc., and was replaced by Isabelle Marcoux. Mr. Marcoux remains on the Board as a director. In September 2012, Alain Tascan, President and CEO of Sava Transmedia, which publishes and develops social games on mobile and online platforms, joined the Board. Ms. Marcoux was also recognized in early December 2012 for her strategic vision and leadership when she received the prestigious Canada's Most Powerful Women: Top 100TM Award.

Outlook

In fiscal 2013, the acceleration of synergies from the integration of the operations of Quad/Graphics Canada, Inc., optimization of the Media Sector structure and continuation of the marketing activation strategy which has enabled the Corporation to renew and expand contracts with key accounts in 2012, should enable it to improve its profitability in a fast-changing industry. These elements should offset the loss of Zellers, a major client who announced in 2012 that it will be closing all its stores by March 2013. The Corporation is also starting fiscal 2013 in an excellent financial position with a net indebtedness ratio of 1.32x. Also, given its planned investment of about $70 million in property, plant and equipment, it should also be generating considerable net cash flows, which will allow it to further reduce its indebtedness, invest in the development of new marketing services and strategic acquisitions, and return funds to its shareholders.

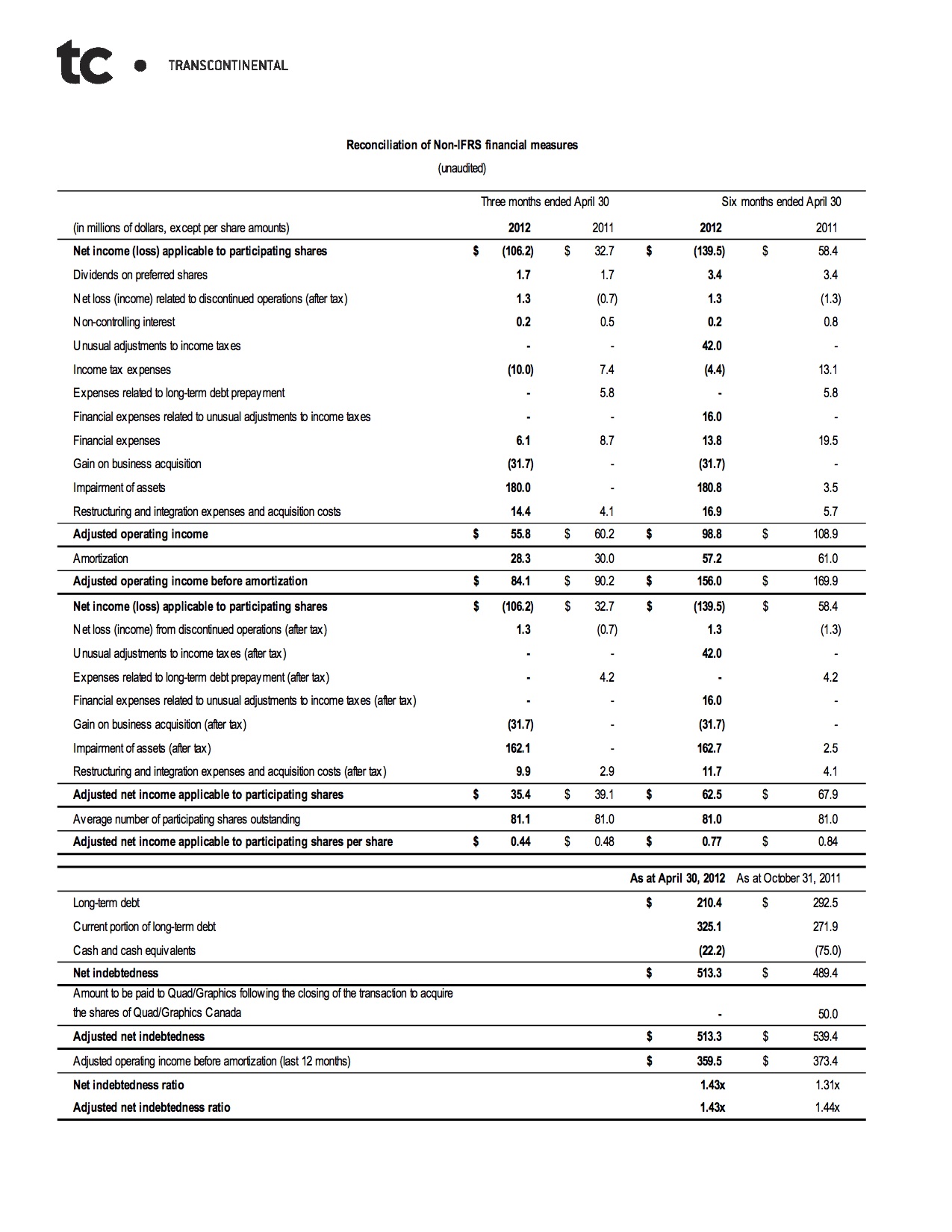

Reconciliation of Non-IFRS Financial Measures

Financial data have been prepared in conformity with IFRS. However, certain measures used in this press release do not have any standardized meaning under IFRS and could be calculated differently by other companies. We believe that many readers analyze our results based on certain non-IFRS financial measures because such measures are more appropriate for evaluating the Corporation's operating performance. Internally, Management uses such non-IFRS financial information as an indicator of business performance, and evaluates management's effectiveness with specific reference to these indicators. These measures should be considered in addition to, not as a substitute for or superior to, measures of financial performance prepared in accordance with IFRS.

The following table reconciles IFRS financial measures to non-IFRS financial measures.

Dividends

At its December 6, 2012 meeting, the Corporation's Board of Directors declared a quarterly dividend of $0.145 per Class A Subordinate Voting Shares and Class B Shares. This dividend is payable on January 18, 2013 to participating shareholders of record at the close of business on December 31, 2012. On an annual basis, this represents a dividend of $0.58 per share. Furthermore, at the same meeting, the Board also declared a quarterly dividend of $0.4253 per share on cumulative 5-year rate reset first preferred shares, series D. This dividend is payable on January 15, 2013. On an annual basis, this represents a dividend of $1.6875 per preferred share.

Additional Information

Upon releasing its fiscal 2012 results, Transcontinental Inc. will hold a conference call for the financial community today at 4:15 p.m. The dial-in numbers are (514) 807-9895 or (647) 427-7450 or 1-888-231-8191 and the access code is: 86820766. Media may hear the call in listen-only mode or tune in to the simultaneous audio broadcast on the Corporation's Web site, which will then be archived for 30 days. For media requests for information or interviews, please contact Nathalie St-Jean, Senior Advisor, Corporate External Communications of TC Transcontinental, at (514) 954-3581.

Profile

Largest printer and leading provider of media and marketing activation solutions in Canada, TC Transcontinental creates products and services that allow businesses to attract, reach and retain their target customers. The Corporation specializes in print and digital media, the production of magazines, newspapers, books and custom content, mass and personalized marketing, interactive and mobile applications, TV production and door-to-door distribution.

Transcontinental Inc. (TSX: TCL.A, TCL.B, TCL.PR.D), known by the brands TC Transcontinental, TC Media and TC Transcontinental Printing, has approximately 9,500 employees in Canada and the United States, and reported revenues of C$2.1 billion in 2012. Website www.tc.tc.

Forward-looking Statements

This press release contains certain forward-looking statements concerning the future performance of the Corporation. Such statements, based on the current expectations of management, inherently involve numerous risks and uncertainties, known and unknown. We caution that all forward-looking information is inherently uncertain and actual results may differ materially from the assumptions, estimates or expectations reflected or contained in the forward-looking information, and that actual future performance will be affected by a number of factors, many of which are beyond the Corporation's control, including, but not limited to, the economic situation, structural changes in its industries, exchange rate, availability of capital, energy costs, increased competition, as well as the Corporation's capacity to engage in strategic transactions and integrate acquisitions into its activities. The risks, uncertainties and other factors that could influence actual results are described in the Management's Discussion and Analysis (MD&A) for the fiscal year ended on October 31st, 2012.

The forward-looking information in this release is based on current expectations and information available as at December 6, 2012. The Corporation's management disclaims any intention or obligation to update or revise any forward-looking statements unless otherwise required by the Securities Authorities.

- 30 -

For information:

|

Media |

Financial Community |